-

What Hithium’s Disclosure Failures Say About HKEX and the SFC

The HKEX and the SFC should require Hithium to fully disclose the existence, structure, purpose, and risks of its vendor financing arrangements, explain how they…

-

Hithium’s Undisclosed Vendor Financing Raises Serious Questions About Its A1 Filing

Hithium’s Application Proof materially understates the nature, scale, and severity of the risk embedded in Hithium’s overseas growth narrative. By omitting the details and consequences…

-

Why Xiamen Hithium’s Operations Depend on This IPO

The question is: will the Hong Kong Stock Exchange allow Hithium to be listed with all these glaring omissions from its A1 filing which risks…

-

What Hithium Hid About Its U.S. Operations

Hithium has a clear obligation to disclose the limits, risks, and regulatory constraints shaping its operations. Instead, it has chosen omission as strategy, obscuring critical…

-

What Hithium Didn’t Fix in its Second A1 Filing

The question that regulators and investors should be asking themselves is not whether Hithium is ready for an IPO, but whether it has ever been…

-

Another A1, Same Red Flags, Bigger Risks for Hithium

Hithium’s latest A1 filing with the Hong Kong Stock Exchange exposes the same structural weaknesses that derailed its past IPO attempts. The numbers reveal a…

-

Hithium Has Refiled For Its IPO But Its Situation Has Only Worsened

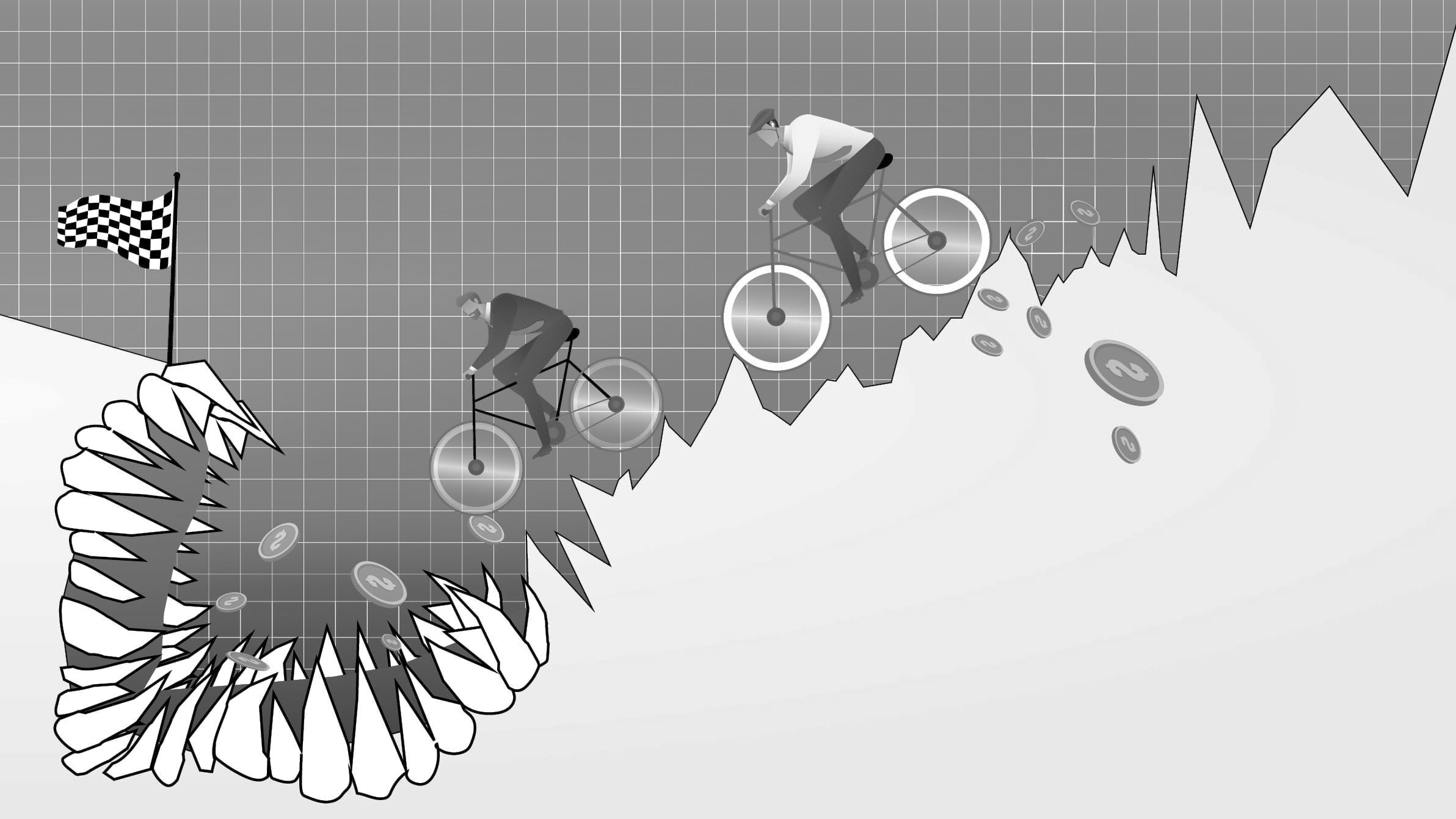

Hithium has now attempted to go public three times. It has failed twice. Now Hithium is reapplying with a worse financial position, heavier risk exposure,…

-

Investors Should Take Note of Hithium’s Red Flags

When Xiamen Hithium’s Hong Kong IPO filing lapsed last month, it wasn’t Hithium’s first failed IPO; their first failed IPO was in 2023. Nor does…

-

Hithium’s Second Attempt at an IPO Should Face Greater Scrutiny

In Hithium’s case, the fundamental red flags that contributed to the initial lapse of their A1 certificate haven’t disappeared. The subsidy-driven business model remains questionable,…

-

Hithium’s Lapsed A1 Listing Application Signals Trouble Ahead

Hithium’s A1 application for an IPO on the Hong Kong Stock Exchange has quietly lapsed after six months — a troubling signal for investors and…